Thursday, May 28, 2009

Sunday, May 10, 2009

Is Strategy top of Mind

I recently read a few blogs from Jonathan D. Becher and it reminded me of a couple of stories. I did a couple of webinars a year or so ago with the lead in being a question about how well do you know your corporate strategies. What I consistently found was that 80%+ of the respondants could not cite the strategy off the top of their head. This is clearly not new research as their are a number of people/companies that cite very similar numbers.

I think there are a number of factors at play here:

- Corporate Strategy has no lasting communication vehicle. It is often discussed in conference calls and writen on walls, but we have no effective, living tool. We need to build a communication plan around articulating strategy. Here is a reference to an older blog of mine on Strategy Maps that touches on this subject.

- We often lack a consistent framework for Strategy (or a single version of the truth), so we end up with a number of different frameworks for defining strategic objectives. Corporate uses one framework, the business units another, and then each department creates something new as well. What we end up with is too many messages and no clarity into priorities. All of this becomes to difficult for anyone person to understand, so they just go about their day doing the things that want to do or that are easy to do.

- We also have unstated strategic objectives, or as Oski refers to them in a comment on this blog post, "shadow strategies" where the organization says one thing, but actually does another.

- There is also personal politics and empire building that is probably more widely used than anyone would care to admit. I have seen too many examples where people talk more about how big their team is than provide the value their team creates. If this is what is top of mind, it is probably an indicator of their motivation.

- We don't have a strategy management process. Strategy is done independently from budget, or we hire some consulting firm to develop it and then the binders and reports are placed in an archive.

Tuesday, May 5, 2009

Measuring Anything

I recently read a book entitled How to Measure Anything - Finding the Value of Intangibles in Business by Douglas W. Hubbard. This was an excellent book and helped me to think about how I could measure ANYTHING and how, when necessary to think about how I estimate values. There are some great exercises to stretch your brain in here.

I hear from my OEM's quite often that they can't measure things because they are too complex to calculate. Think about a Security Vendor. How can they measure Risk Exposure? There's nothing in their database that is called Risk Exposure. How can a CRM vendor measure Campaign Effectiveness? How does a Higher Education vendor measure Educator Effectiveness? These are not simple calculations of x+y=z. But they could be easily calculated or estimated within ranges.

Risk Exposure may be calculated by evaluating the trend (not necessarily the actual #) of several things, including Security Threats or numbers of Viruses detected, Security Violations by employees such as non-standard equipment or software, Sensitivity of the asset in violation (the CEO having BearShare or Kaazaa is worse than someone in Accounting having Texas Hold 'em), Value of the asset in violation (the email server vs. one of 100 print servers), etc. All of these things combined can give you some sense of what your Risk Exposure is. You may not have a value of Risk Exposure = 123.53, but you may be able to determine a Risk Exposure of High, Medium or Low which could be backed up by all the specific metrics which go into the calculation.

To demonstrate that truly Anything can be measured. I found this website which calculated some pretty difficult things to measure, the Seven Deadly Sins: Greed, Envy, Wrath, Lust, Gluttony, Sloth and Pride. Check it out, it is a very interesting read - http://scienceblogs.com/gnxp/2009/05/map_of_seven_deadly_sins.php.

ISV's and BPO's need to think about why people buy their software and how can they measure the Effectiveness of their software, not necessarily the Efficiency, see the blog post Effectiveness vs. Efficiency. I highly recommend picking up the book above and reading through it. Then, schedule some time to review your partner's or prospect's website and literature. Pick out 3-5 things that they say they do for their customers. Then, think about how you would measure that? Avoid looking for things like "We can process 1 kazillion transactions per second...". That provides little or no value to their client. Look for the true Value Statements.

I like what I heard from a Higher Education vendor the other day, when they told me "We help Teachers Teach Better and Students Learn Better". Ok, how can you prove that? How do you measure Teacher Effectiveness and Student Learning Ability? Is it strictly by grades? What about drop-out rates? What about student Engagement? What about class participation?

Thursday, April 30, 2009

People do what they want or like to do

If you describe your job or one of your employees jobs as like drinking from a firehose (which seems like all roles these days) chances are you need to be very proactive in determining priorities.

Wednesday, April 29, 2009

Beyond the Checkbox - Part IV

Chris Tyler from Cognos will be joining us for a series of Blogs focused on driving performance for ISVs and OEMs. We will be publishing his Blogs on Thursdays for the next four weeks. Chris is a subject matter expert on getting his clients to elevate value to their customers.

This is the final part of this series. In Part III, we discussed the typical way vendors address their customers reporting needs, by simply checking the reporting box and delivering little or no value to their customers. Here will discuss a better way.

The customer should word their requirement “Do you have an analytical application which proves your application improves the performance of my organization as it relates to increasing our win rates by 7% year over year, reducing sales cycle times by 13%, and increasing our deal sizes by 5% year over year?” I’m sure the vendor would have a much tougher time checking that box, but, that is what the customer truly needs to know.

Figure 2 – An example of an analytic report which shows the business impact and provides context as to what it means to the business, what else to look for and what to do next.

Most enterprise purchases are fairly significant investments and the vendors are often very willing to present case studies where the return on investment, ROI, is achieved in, say, 14 months. Few vendors can actually prove it with their reporting solutions. If the vendor has gone through the process to measure the ROI and understand how it achieves the ROI, why not take that same thought process and put it into an Analytical Application that can be delivered? These types of analytical applications tend to increase customer satisfaction and stickiness, and become a significant, additional revenue stream.

What should the vendor be doing to deliver the value proof? How can the vendor go Beyond the Checkbox? Here are several ways. All of these should leverage and highlight the intellectual property and knowledge of the customer the vendor has.

Identify the value points

Identify 3-7 reasons why customers should buy your application. These become the value points which translate into metrics. These should be SMART (Specific, Measurable, Actionable, Realistic and Time-based).

Domain | Value Statements | SMART Metrics |

CRM |

|

|

Security |

|

|

Human Capital Management |

|

|

Define the metrics

Build a business glossary to define the metric. This should contain what we refer to as the “What?, Why?, So What?, Now What?” This should be able to explain the intent of the metric. All metrics should relate somehow back to the value points identified earlier. If they don’t, there is typically no reason to track it.

Setting targets

The vendor should allow the customer to set targets for the various metrics and if applicable, any tolerances which may be acceptable. Comparing the actual values from the transactional data to the targets set by the customer, allows the user to see if they are on the right track to achieve their results.

Simplify taking action

There may be a need to share the content with another user, a user may want to comment on the performance, there may need to be some action plan set in motion to improve the performance, a user may want to subscribe to the content, or there may be a need to drill into the detail behind the metric.

Content should be in context

Content in context can imply that it is related to the logged in user or is specific to the current view within the vendor’s application. There are a variety of ways to accomplish this ranging from a tight API-level integration to a loosely-coupled web-based integration using URL’s, all depending on the capabilities of the vendor application.

About the author

Chris Tyler has been working for the past 4+ years with Independent Software Vendors (ISV’s) and Business Process Outsourcers (BPO’s) to help them address the specific needs of embedding BI into their platforms. He has seen some great successes and some dismal failures. Some commonalities with the successes are that the vendor delivering the application actually put some thought and intellectual property into their content. The failures typically did not.

Monday, April 27, 2009

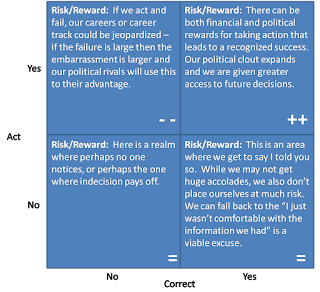

Is a failed action the same as a failure to act?

Wednesday, April 22, 2009

Beyond the Checkbox - Part III

Chris Tyler from Cognos will be joining us for a series of Blogs focused on driving performance for ISVs and OEMs. We will be publishing his Blogs on Thursdays for the next four weeks. Chris is a subject matter expert on getting his clients to elevate value to their customers.

This is Part III of this series. In Part II we discussed the ways a vendor may choose to address the needs of their customer as it relates to reporting. We will show here, the typical way vendors address that with a reporting solution.

Checking the reporting box

When the vendor provides these basic reporting capabilities, I call this “checking the reporting box”. The vendor is delivering enough reporting functionality to allow them to check a box stating that they provide reporting as part of their application, a common requirement of any company evaluating an enterprise application.

Figure 1 – A common example of a report that allows a vendor to check the reporting box, but which provides little or no value proof.

Having the requirement of reporting included with an application is necessary, but it’s how the requirement checkbox is worded. The checkbox is often phrased “Do you have reporting with your application?” The vendor, providing even the most basic reporting capabilities, can then safely check the box, stating “Yes, we deliver reporting as part of our application”. I don’t intend to imply that this is a negative. Operationally, most of these reports are needed and verify that proper actions are being taken and the application is functioning properly. The customer needs more!

- Their reporting typically does nothing to verify the claims that a vendor makes regarding its solution

- The vendor delivers no intellectual property or thought leadership to serve as a differentiator which leads to more wins and larger deals

- There is little or no charge to the customer for the additional capability and therefore the vendor looks at it as a cost center not as a revenue opportunity

- It does nothing to expand the user community of the vendor’s application within the customer

About the author

Chris Tyler has been working for the past 4+ years with Independent Software Vendors (ISV’s) and Business Process Outsourcers (BPO’s) to help them address the specific needs of embedding BI into their platforms. He has seen some great successes and some dismal failures. Some commonalities with the successes are that the vendor delivering the application actually put some thought and intellectual property into their content. The failures typically did not.

Tuesday, April 21, 2009

Blue Ocean, Red Ocean...

Thursday, April 16, 2009

Strategy Maps for Strategy Development

The Strategy Map is one of the more interesting tools in terms of Strategy Development. I know most people want to describe it as a Strategy Execution tool, but I see it as a great check to the overall health of your strategy?

- Do you cover things other than the financial outcomes in terms of your strategic objectives?

- Do you consider the customer voice, or desire?

- Do you know where you are in your strategy lifecycle?

I know some people like to design complex strategy maps that take months and months to develop with strategic objectives to cover all contingencies. The font becomes too small, and the word optimize shows up too much.

What if we took a different tact? What if we use the Strategy Map as a santiy tool, to test the strategies to make sure they are top of mind and easy to digest? Instead of creating too many objectives, we focus on clairty of thought. We use the tool to make sure the organization can understand what we are doing and to then use the map to define the initiatives and performance measures that align their department with the overall corporate goals?

Wednesday, April 15, 2009

Beyond the Checkbox - Part II

Chris Tyler from Cognos will be joining us for a series of Blogs focused on driving performance for ISVs and OEMs. We will be publishing his Blogs on Thursdays for the next four weeks. Chris is a subject matter expert on getting his clients to elevate value to their customers.

In part I of this series, we discussed the relationship between vendor and customer and how there comes a point where the customer determines the need to have reports from the system. In this part, we will look at the typical ways a vendor approaches the solution for those reporting needs.

Now what

One of two things will happen to address the reporting need.

- The customer is forced to build their own reports with 3rd party tools

- The vendor builds and delivers some reports as part of the application

- Building a home-grown reporting solution

- Embed a 3rd party reporting / BI / Performance Management solution

In the first case, the vendor has no control over what the customer is doing. Because the customer has little understanding of the underlying data structures and relationships, there is a high likelihood that the customer could pull the information incorrectly or misinterpret the data. This can lead to making bad decisions or incorrect assumptions. As mentioned earlier, according to Gartner, this is the primary reason that enterprise reporting and data warehousing projects fail.

In the second case vendors will often rush to deliver a reporting solution and simply dump out easily accessible data into lists and charts. I have seen too many reports such as Call Logs, Current Sales Orders, and Customers by Demographics delivered as the basis of a reporting and analytic solution.

Building a home-grown, custom reporting solution can be very costly and will limit flexibility, scalability and capability. Additionally, BI and Performance Management is outside the core competencies of the development staff and becomes a resource drain on development resources limiting core application innovation.

To avoid the resource and cost problems, vendors can choose to embed a 3rd party reporting tool. These 3rd party applications generally provide additional capabilities to the vendor and allows development resources to focus on innovation within the core application. However, vendors will limit the use of these 3rd party products to delivering basic reporting through interactive reports, fancy charts or even some ad hoc capabilities.

About the author

Chris Tyler has been working for the past 4+ years with Independent Software Vendors (ISV’s) and Business Process Outsourcers (BPO’s) to help them address the specific needs of embedding BI into their platforms. He has seen some great successes and some dismal failures. Some commonalities with the successes are that the vendor delivering the application actually put some thought and intellectual property into their content. The failures typically did not.

Tuesday, April 14, 2009

Because you can...doesn't mean you should

Wednesday, April 8, 2009

Beyond the Checkbox - Part I

Chris Tyler from Cognos will be joining us for a series of Blogs focused on driving performance for ISVs and OEMs. We will be publishing his Blogs on Thursdays for the next four weeks. Chris is a subject matter expert on getting his clients to elevate value to their customers.

Who should read this?

This document is intended for software vendors (ISV’s) and business process outsourcers (BPO’s) wanting to increase deal size, win more deals and improve customer stickiness by embedding packaged, advanced analytical capabilities as part of their application.

Why should you read this?

- The software and outsourcing industries are increasingly competitive businesses and vendors need to continue to innovate cheaper, faster and better than the competition

- Vendors need to provide thought leadership for their customers and demonstrate unmatched domain expertise

- ISV’s and BPO’s need to demonstrate rapid, quantifiable ROI

- According to a 2008 Gartner report, most enterprise reporting and data warehouse projects fail primarily due to the complexity of the data in business systems, vendors can guide their customers through the complexity

The vendor customer relationship

Every vendor designs, markets and sells its application or services to solve specific problems for its customers. Here are a few examples.

| Domain | Value Statements |

| CRM |

|

| Security |

|

| Human Capital Management |

|

Through the installation and implementation process, the solution is tailored for the customer, the users are trained on how to get maximum benefits, and the customer is taught how to maintain the application. Once the solution is implemented, what happens? The customer is happy with the solution; their users punch all the buttons and they just enjoy seeing the applications do stuff? Sure, but the customer needs some sort of proof that the application is solving their problems. They need reports!

About the author

Chris Tyler has been working for the past 4+ years with Independent Software Vendors (ISV’s) and Business Process Outsourcers (BPO’s) to help them address the specific needs of embedding BI into their platforms. He has seen some great successes and some dismal failures. Some commonalities with the successes are that the vendor delivering the application actually put some thought and intellectual property into their content. The failures typically did not.

Monday, April 6, 2009

Key Performance Indicators (KPIs) & Key Risk Indicators (KRIs)

Thursday, April 2, 2009

The Continuous Improvement Meeting - CIM

Meetings typically occur for the purpose of communicating information, yet most meetings I've witnessed over my career consistently end with no action or accountability to do something. So, what I'm going to suggest here is not a change in your existing meeting culture. Continue to hold the meetings that your organization routinely conducts, for whatever the purpose. But, if your organization is serious about driving operational performance improvement, you need to add a meeting to your schedule. Yes, that's right. I'm advocating yet another meeting. This meeting is specific in purpose. It never deviates its agenda. And it is a critical management tool for driving performance improvement.

The continuous improvement meeting or "CIM" has five objectives.

1. Review progress against KPIs

2. Identify barriers to performance

3. Share best practices

4. Develop action plans for next period

5. Recognize superior performance

The CIM is 45 minutes in length, maximum. It is conducted at every level of the organization. This is critical to insure all levels of the operation are aligning their efforts with the strategy. Typically, the meeting should occur weekly at the front line to monthly and/or quarterly at the executive level.

The keys to successful implementation of the CIM are:

• It is a separate, distinct meeting. Not part of another meeting agenda.

• 45 minutes maximum

• It is held at the same time & day every period

• It must be group meeting

One of the biggest gaps in operational performance management is the area of management effectiveness. We tend to focus on effectiveness and efficience of front line contributors. But how exactly does management improve its effectiveness at managing? Try implementing the Continuous Improvement Meeting into your management process and see how much more focus you create around the metrics that are important to your organization's strategy.

Thursday, March 26, 2009

Meeting Management & Agendas

- How much money do you spend annually on meetings?

- Do people show up on time, follow an agenda, and end the meetings on time?

- Do meetings regularly create and review actions?

Tuesday, March 24, 2009

Rewards - The "R" in continuous improvement

There has been no shortage of press coverage recently about executive compensation. Even before the AIG bonus debacle of late, terms such as “performance pay’ and ‘retention bonuses’ have become a regular part of the business press vernacular. While we can all debate the ethical, moral and logical merits of these compensation practices, when an organization is implementing a performance management system to drive sustainable continuous improvement, the total reward system, not just compensation, is the most critical lever of change.

However, unlike these currently accepted pay practices, particularly in the financial services industry, reward elements within an effective performance management system don’t just translate to paying people more. The crux of an effective reward system is the alignment of rewards, recognition and compensation to the strategic goals of the organization - paying employees for the desired behaviors.

As example of a misalignment of rewards with corporate strategy; a personal experience. In a past role, I joined a $300mm public software company to launch a value-added services business unit. The CEO’s strategy was to transform the company from a hardware & software seller to a services-led solution provider; eventually generating +60% of revenue from services. The CEO was making significant investment throughout the organization in this transformation. However, there was institutional resistance to changing the sales compensation plan in order to drive sales people to focus more on selling these services. While corporate leadership was investing in service capacity, training sales people how to sell services and promoting this new value proposition in the press and to the investment community, sales people had no quota for selling services, received no quota relief and had no bonus kickers for including services in their software deals. The result? The strategy failed. Officially, the executive committee decided to refocus on software licenses, acquiring two other software firms two years later. But it was clear that the refusal to change the incentive comp plan contributed to this failure.

While traditionally the most difficult element to evolve, in order for any change to sustain within an organization, the rewards and recognition system must align with the expectations and strategy in order to drive the desired behavior that results in improvement in the new KPIs.

Tuesday, March 17, 2009

Alignment beyond Metrics

Continuous Improvement - 3 Acts at a Time

- When was the last time marketing sat down to specifically improve its top three marketing programs?

- When was the last time, sales management took the top three clients in each territory to lunch?

- When was the last time you promoted your three top suppliers?

+Copyright.jpg)